P2P Lending Survey Results

What are the things that investors look for in a P2P lending marketplace? What would they change in existing ones? What are the mechanisms that make their investments safe? What is the market’s risk/return expectancy?

In order to answer the above-mentioned questions, we surveyed a sample of 100 people representing P2P investors in Europe. Of the participants, 62% are between 25 and 44 years old and 58% were male. Respondents had eight different European nationalities. They all have investment experience with P2P lending marketplaces.

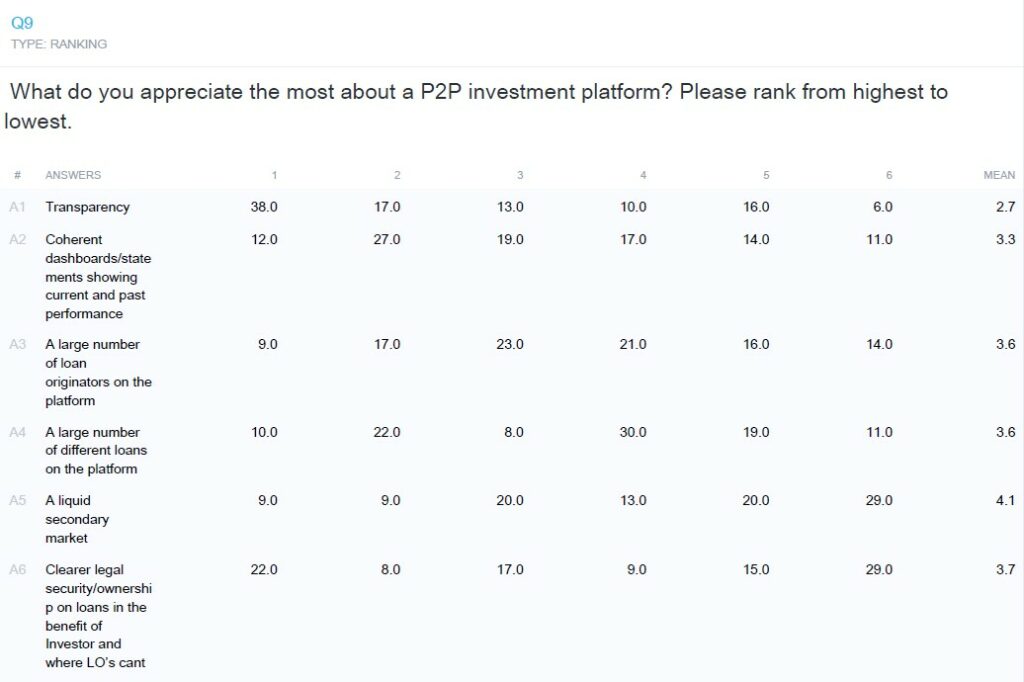

The results show common themes. People wish for more transparency. The majority of surveyed wish for the investment in loans to be less risky, even at the expense of a slightly lower average return. Lastly, the results show that investors are increasingly losing trust in LOs and seek a safety net above and beyond the buyback guarantee.

1) Transparency

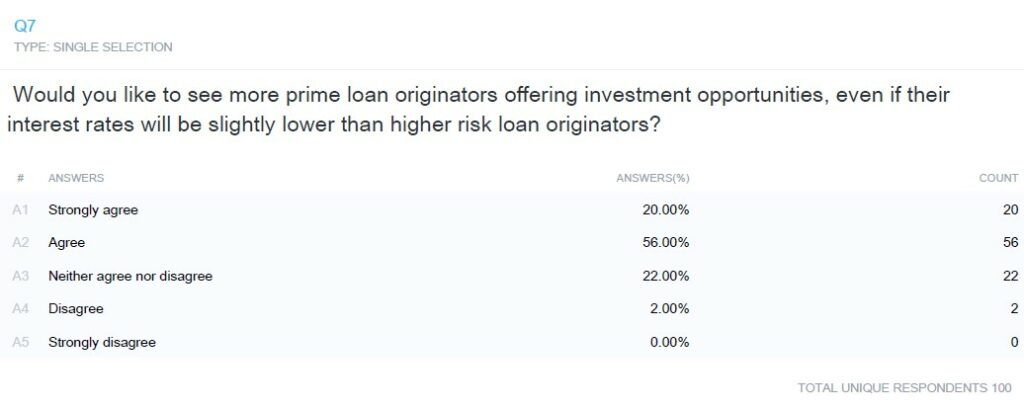

2) Lower Risk

When asked whether investors would like to see more prime lenders with higher safety but lower returns only 2% disagreed. The overwhelming majority is looking for safer P2P investments.

We have also asked whether investors would be willing to earn a 6-9% interest rate (compared to the rather high double digit yields prevalent in the P2P market) but with higher safety. Only 7% disagree, and no one strongly disagrees. At Income marketplace, we also believe it is the risk-reward ratio that needs to be optimized. Ultimately investors are willing to deal with lower returns if provided with a much safer investment. This is in the benefit of both loan originators and investors.

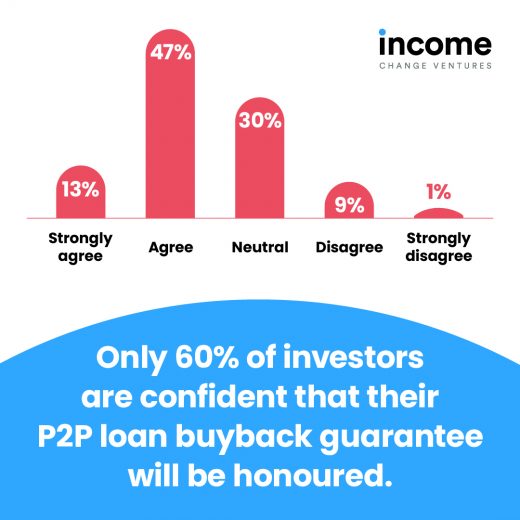

3) Buyback Guarantees

We designed the survey to understand the P2P lending market sentiment better and to validate if what we observed was correct. The results were in line with what we expected and we feel validated that the cashflow buffer, the extra security beyond the buyback guarantees, and transparency is what investors need in order to confidently continue investing into this asset class. Read more about the cashflow buffer in our “3rd generation P2P blog post”.