We have talked about the benefits of our Auto Invest feature before. We want to help you set up your Auto Invest to work most effectively with this post.

There are two options for how to set up your Auto Invest:

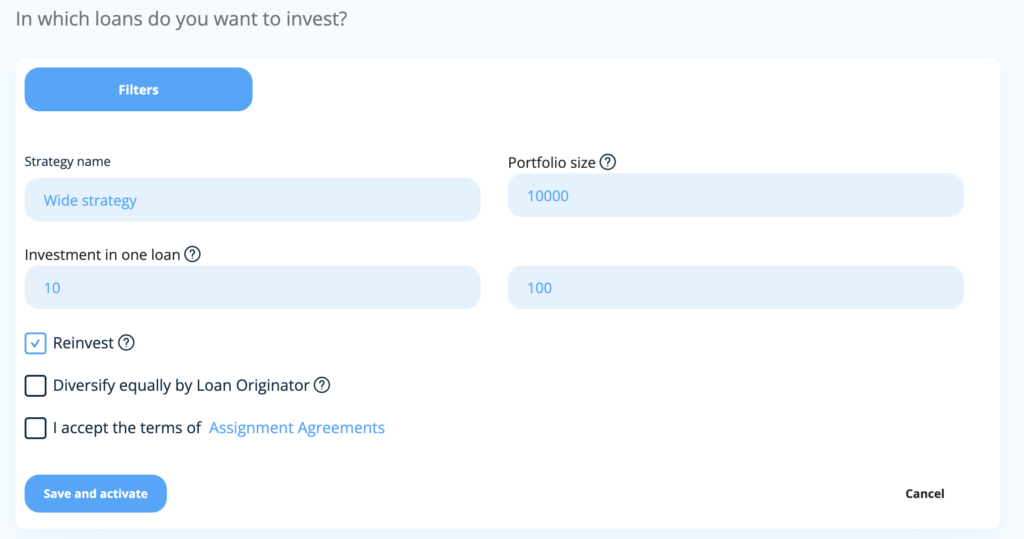

You can set up a wide Auto Invest strategy that picks up loans with a specific yield and term. Beginner investors mainly choose to use this kind of strategy.

A few things to keep in mind for the best Auto Invest performance:

Firstly when you choose to “diversify equally by Loan Originator,” your Auto Invest may not efficiently deploy all the funds when some LOs don’t have enough loans on the platform. The function is built so that it diversifies equally between all selected LOs, and if one LO doesn’t have enough loans, then it cannot diversify equally; therefore, it won’t invest at all.

Secondly, you should set the maximum portfolio size larger than your actual portfolio. That way, your earnings get automatically reinvested.

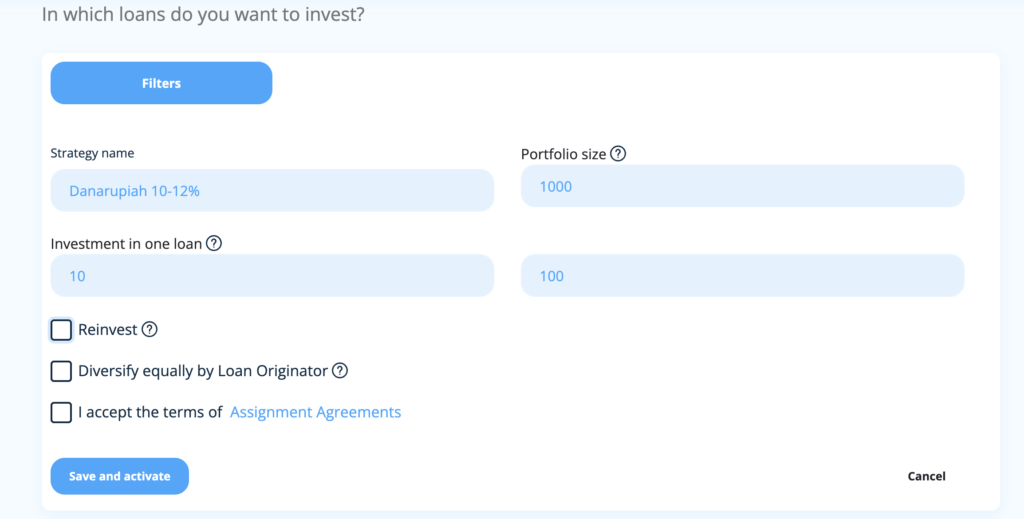

For maximum control, many experienced investors prefer to set a different Auto Investment strategy for each LO. In this case, you split your portfolio into Loan Originators yourself and control investments to each LO through a LO-specific Auto Invest strategy. For example, if your total portfolio is € 5000 and you want to diversify between 5 LOs, you create a strategy with a maximum portfolio size of € 1000 for each of the LOs.

Then you need to set the investment size in one loan. The minimum is € 10, but the more significant the maximum you set, the fewer loans your strategy has the option to invest in.

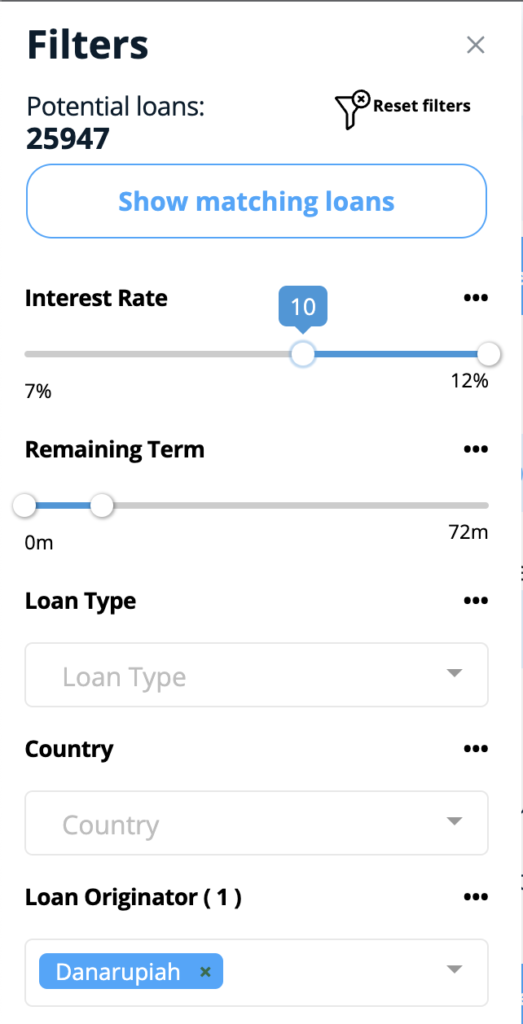

Before you activate your Auto Invest, you also need to pick the LO in the filters; this way, the strategy only invests in the chosen LO. You can also select the remaining term and interest rate from the filters.

When picking the term and interest rate, keep in mind the LO specifics, like some LOs only offer long-term loans and lower interest rates. Therefore when you want to invest in, e.g., Finto’s loans setting the remaining term too short might end up with your strategy not working.

Splitting up your portfolio by yourself allows you better control of your portfolio. Still, you must create a new strategy for every new LO and manually increase the strategy’s maximum portfolio size when you want your Auto Invest to reinvest your earnings.

When you create a new strategy, set the maximum portfolio size larger than your current portfolio to ensure that the strategy will keep running for the total amount of your portfolio and earn you up to 12% p.a. even if the payments come back.

We want to note that it is always an excellent idea to diversify your portfolio, especially between different countries.

Whether you are a beginner or a pro, we hope this guide will help you maximize your portfolio and earn 12% p.a.

Sign in now and make Auto Invest work for you the best way possible!