As we bid farewell to 2023, it’s time to reflect on the incredible journey we’ve had at Income. Join us as we delve into the highlights of the year, showcasing our total investments and returns, top-performing investments, diversification overview, new features, due diligence updates, and investor insights.

Total Investments and Returns:

Investors on Income experienced favorable growth in assets and returns throughout 2023, despite facing cash drag toward the end of the year.

Loan Originators listed loans worth €50,894,130, which offered investors a diverse range of investment opportunities. The active participation of investors in the platform was evident in their investments of €52,473,570, highlighting their confidence in the investment opportunities presented.

€50,488,631 worth of loans were successfully fulfilled during the year. Income’s active portfolio grew by 53%, which is evidence of the increasing popularity and trust among investors.

Investors earned €1,453,381 in profits throughout the year, with the average interest rate for loans on the platform being a competitive 14.6%.

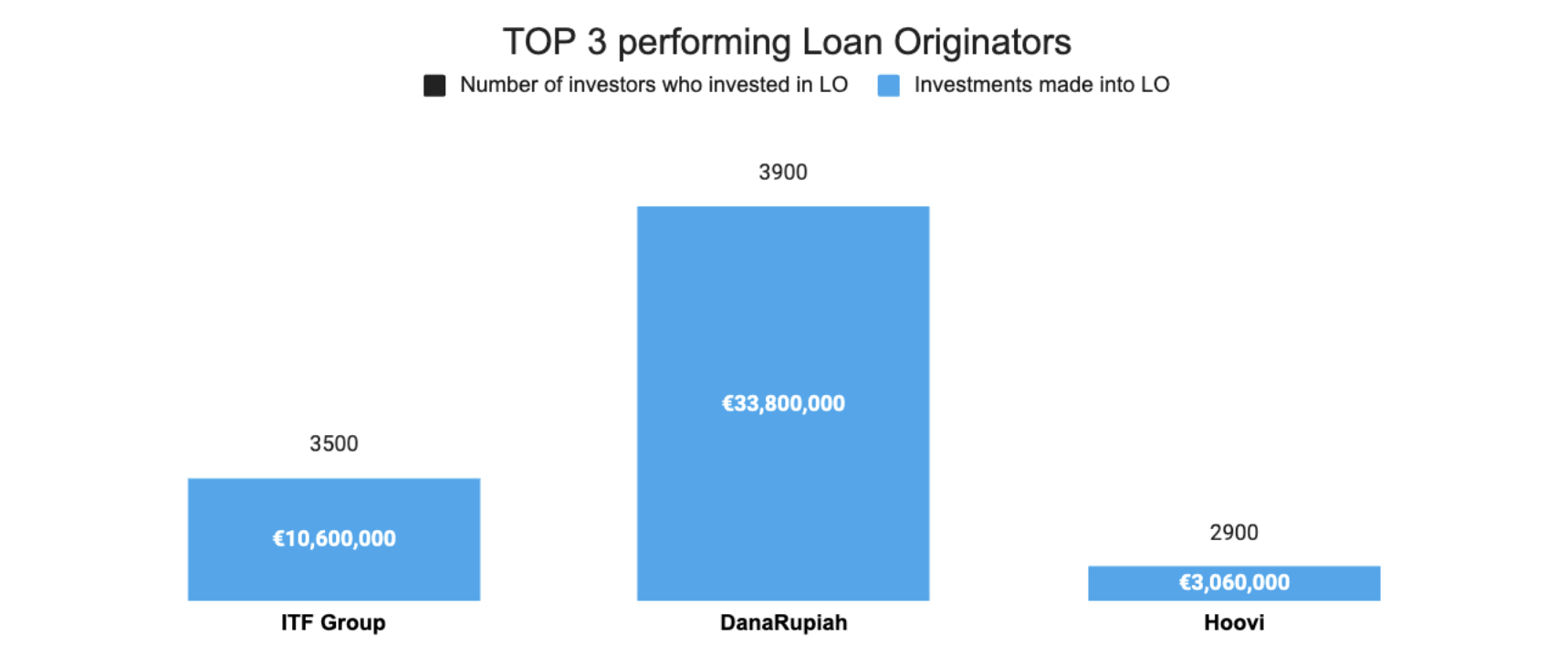

TOP Performing Investments:

These top-performing Loan Originators, each with its unique appeal, garnered substantial interest and support from Income’s Investors.

1. DanaRupiah:

€33.8 million was invested into the loans offered by DanaRupiah, and the popularity of their loans was evident, with a substantial 3,900 investors choosing to add this Indonesian Loan Originator into their portfolio.

2. ITF Group:

Investors invested €10.6 million in the loans originated by ITF Group, showcasing the attractiveness of this investment option and the widespread appeal of their loans is highlighted by the engagement of 3,500 investors.

3. Hoovi:

Hoovi secured €3.06 million in investments, establishing itself as a formidable contender among the top-performing investments on Income. 2,900 investors chose to align their investment strategy with the Estonian SME lender, recognizing the value and promise embedded in the loans it presented.

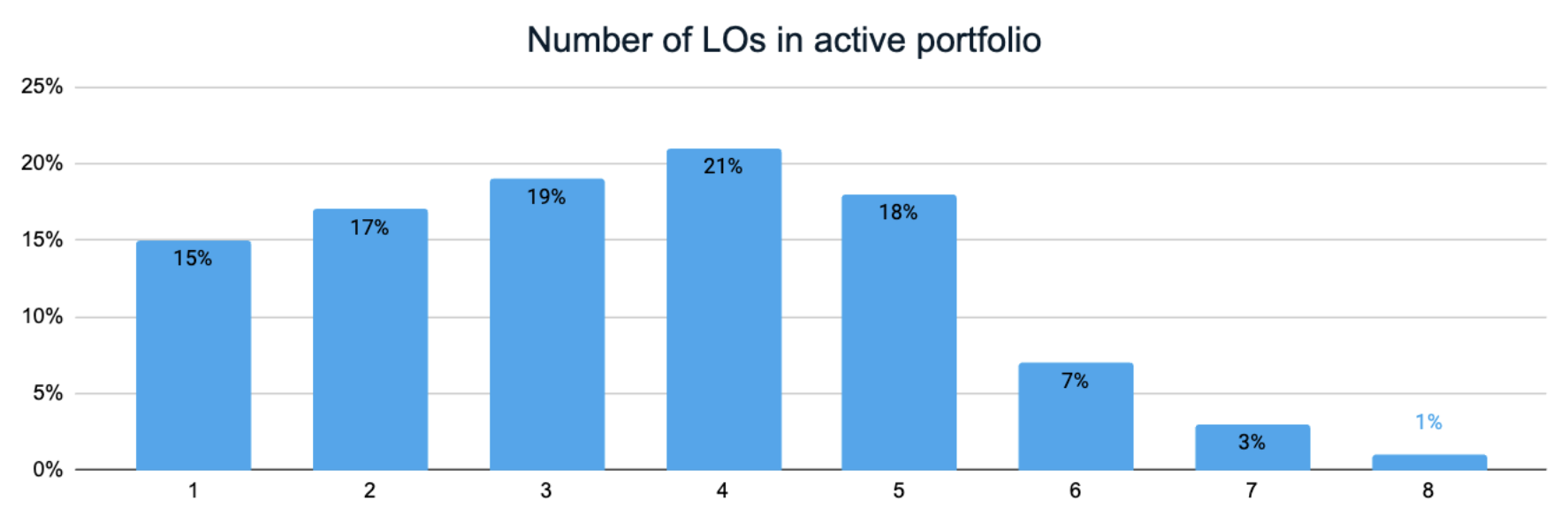

Diversification Overview:

Diversification is an important tool to mitigate risks when investing and notably, 68% of the investors on Income have invested in more than 2 Loan Originators, indicating a healthy overall diversification on the platform.

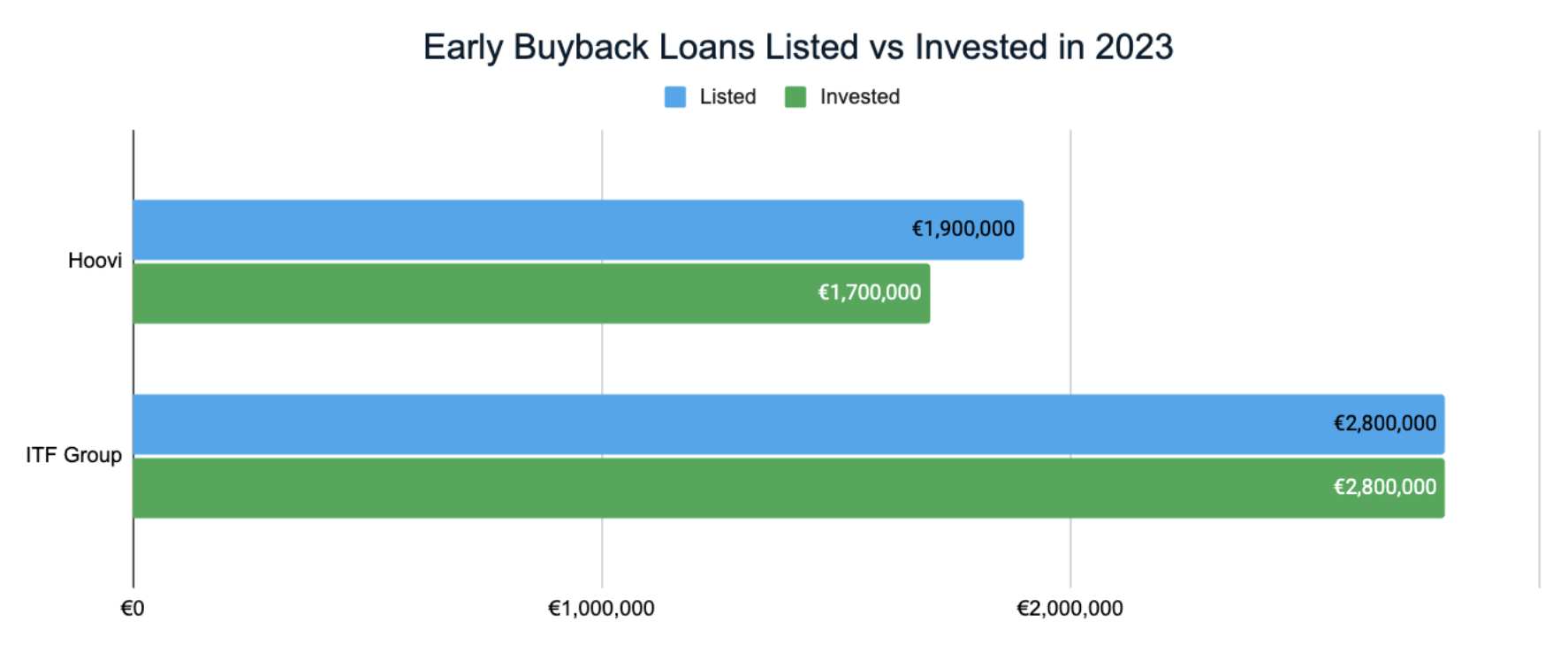

New Feature – Early Buyback:

In a stride towards enhancing the user experience and responding to the needs of both Loan Originators and investors, Income introduced the Early Buyback feature at the onset of 2023. This feature has since garnered enthusiastic responses, proving to be a valuable addition to the platform.

First, to embrace the Early Buyback feature was Hoovi, whose listed loans on the platform amounted to €1.9 million. The investor community responded positively to Hoovi’s Early Buyback offerings, resulting in investments totaling €1.7 million. This inclusion marked a significant step forward in providing more flexibility and options for investors.

ITF Group also recognized the potential of the Early Buyback feature, and listed loans totaling €2.8 million on the platform, which all got invested. The inclusion of this feature contributed significantly to the diversification of investment opportunities and met the demands of investors.

Highlights of Due Diligence updates and new products

In 2023, Income conducted yearly due diligence updates on Loan Originators, which resulted in the introduction of new products and a lowering of the Junior Share for the two biggest on Income. The due diligence process is a crucial step in evaluating the quality of loans provided by our Loan Originators and assessing factors such as historical repayment performance, cash generation on a portfolio basis, and overall profitability.

As a result of our due diligence update, DanaRupiah’s Junior Share was changed from 35% to 22-35%, providing more flexibility for investors. In addition, DanaRupiah started listing instalment loans up to 60 days, expanding their range of offerings.

ITF Group’s due diligence update allows them to list a higher amount of loans with different maturities and borrower types in 2024.

Investors on Income Overview:

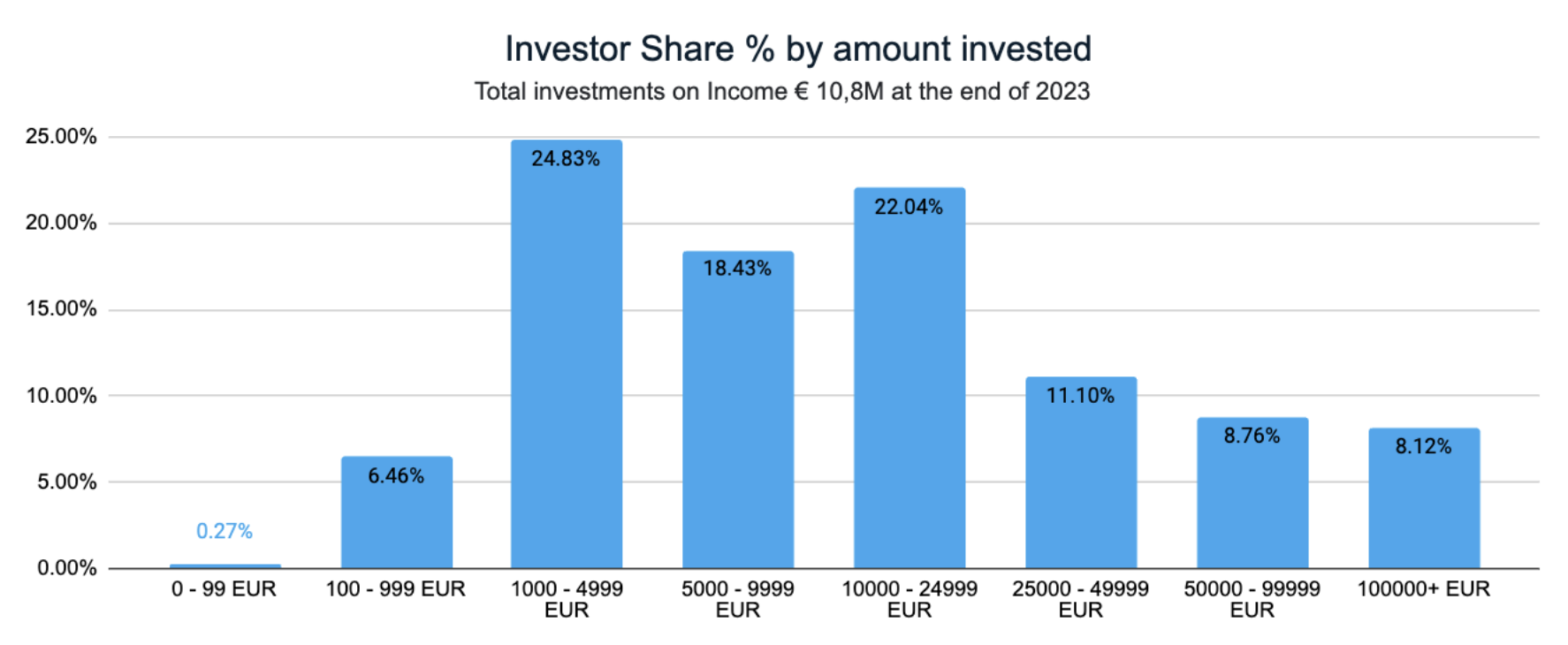

The distribution of investments on Income by the end of 2023 provides a fascinating insight into the diverse range of investors and their commitment to the platform.

Approximately 40% of investors on Income fall into the mid-range part of investment amounts between 5000 to 25 000 EUR. Additionally, investments surpassing EUR 100,000 command a significant 8.12% share, emphasizing the presence of high-value contributors within the investor community.

Approximately 40% of investors on Income fall into the mid-range part of investment amounts between 5000 to 25 000 EUR. Additionally, investments surpassing EUR 100,000 command a significant 8.12% share, emphasizing the presence of high-value contributors within the investor community.

In contrast, investments below EUR 100 have a minimal 0.27% share, draw attention to the substantial investment amounts and trust.

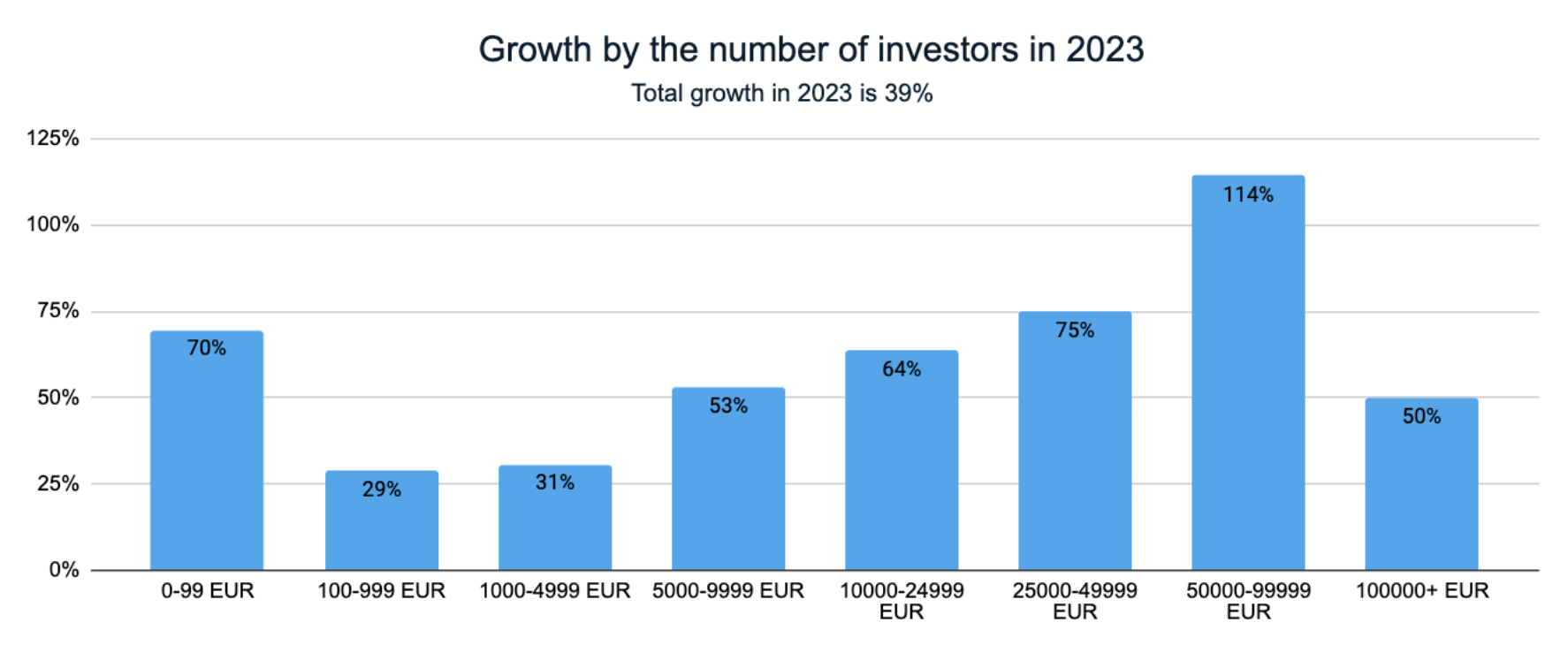

Collectively, the total growth in the number of investors across all categories in 2023 reached 39%, underscoring Income’s appeal and ability to cater to a diverse investor base.  Both new and existing investors actively increased their participation, notable spikes in growth were observed in higher investment categories, particularly in the range of EUR 50,000 to EUR 100,000 (+114%), EUR 25,000 to EUR 50,000 (+75%), and the category above EUR 100,000 (+50%). Additionally, substantial growth was seen in the EUR 10,000 to EUR 25,000 (+64%) and EUR 5,000 to EUR 10,000 (+53%) categories, showcasing a balanced growth pattern across various investor segments.

Both new and existing investors actively increased their participation, notable spikes in growth were observed in higher investment categories, particularly in the range of EUR 50,000 to EUR 100,000 (+114%), EUR 25,000 to EUR 50,000 (+75%), and the category above EUR 100,000 (+50%). Additionally, substantial growth was seen in the EUR 10,000 to EUR 25,000 (+64%) and EUR 5,000 to EUR 10,000 (+53%) categories, showcasing a balanced growth pattern across various investor segments.

Memes from Income’s Telegram Group:

A lighthearted touch as we share some of the humorous memes from our Telegram group, poking fun at the low volumes of loans on the platform lately. A sincere thank you to our investors who have bared with us through this difficult time and have managed to uplift the team’s and fellow investors’ spirits.

Laughter is the best investment, after all! Cheers to a prosperous new year that is filled with more laughter and more loans on the platform.