Income’s 2025 Recap: Growth, Expansion, and What Comes Next

As we close the chapter on 2025, it is the perfect time to reflect on a year defined by strong platform activity, meaningful progress on our long-term vision, and continued trust from our investor community. Income continued to scale its marketplace, strengthened repayment performance, and broadened its Loan Originator base with three new additions that brought new loan categories and new momentum to the platform.

Here is a comprehensive recap of Income’s 2025 highlights and milestones.

A Strong Year for Our Platform: Performance Overview

In 2025, €71.1 million worth of loans were listed, offering investors a growing supply of diversified opportunities. Investor confidence remained strong, with €66.8 million successfully invested across the year. More importantly, €64.3 million in repayments were made to investors, reflecting the continued reliability of loan performance and a strong repayment flow throughout the year.

Our active portfolio grew by 29.75% in assets under management (AUM). While this growth rate was lower than the exceptional expansion seen in 2024, it remains a clear signal of continued engagement and a platform that is steadily building scale. The average interest rate remained high at 13.51%, continuing to provide attractive return potential across the marketplace.

“Our mission has always been to empower investors with secure, high-yield opportunities. In 2025, we reinforced this foundation by expanding loan supply, onboarding reliable Loan Originators, and pursuing responsible marketplace growth – strengthening long-term trust and sustainability.”— Lavrenti, CEO of Income.

Loan Originators: Driving Growth and Expanding Horizons

Loan Originators remain at the core of Income’s ability to offer consistent and diversified opportunities. In 2025, our established partners continued to drive high investor participation and strong volumes, while the platform also welcomed three new Loan Originators that broadened our loan offering and showed strong early traction.

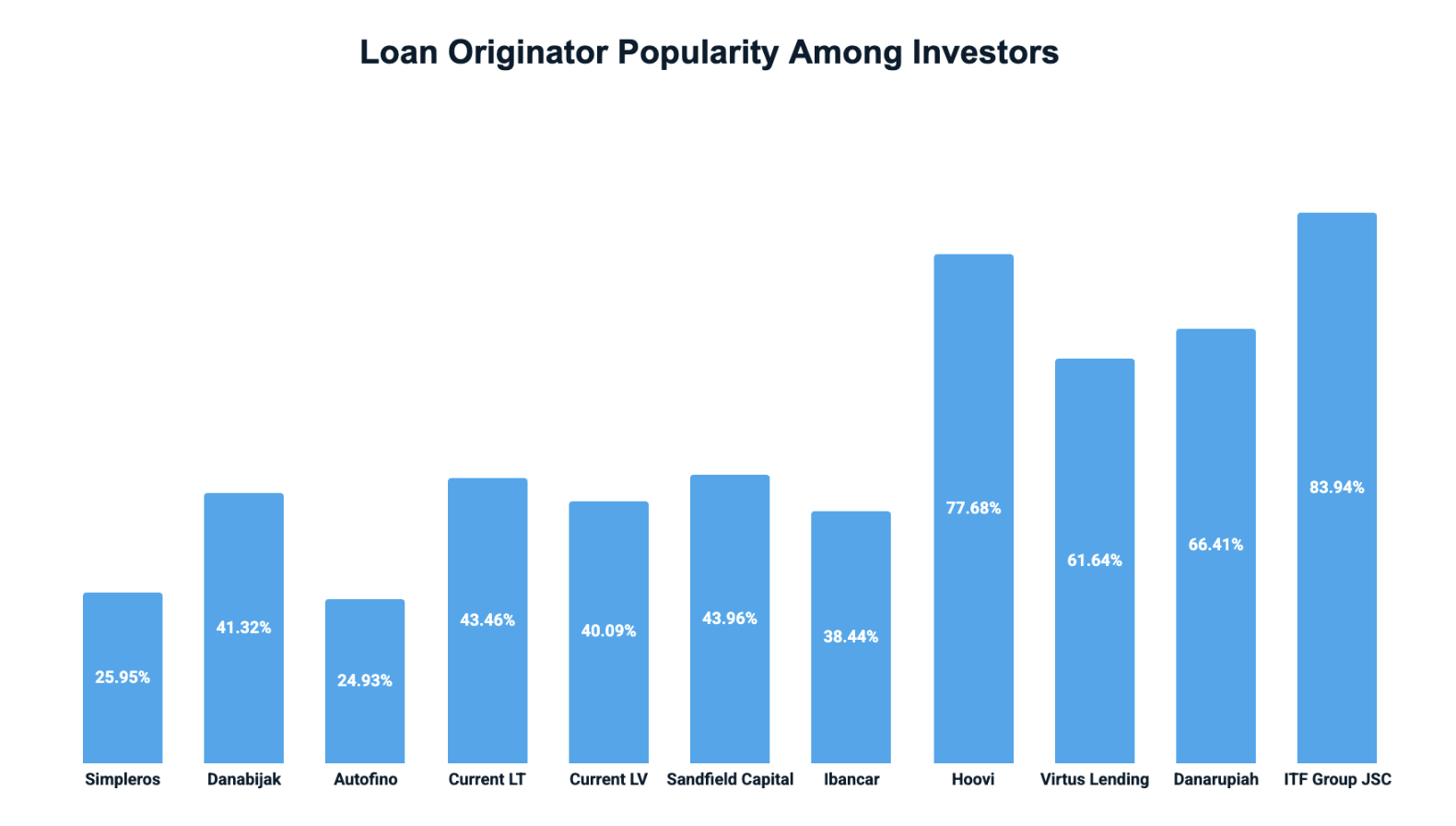

Investor participation remained strongest among our top partners, with ITF Group JSC leading at 83.94%, followed by Hoovi at 77.68%, Danarupiah at 66.41%, and Virtus Lending at 61.64%.

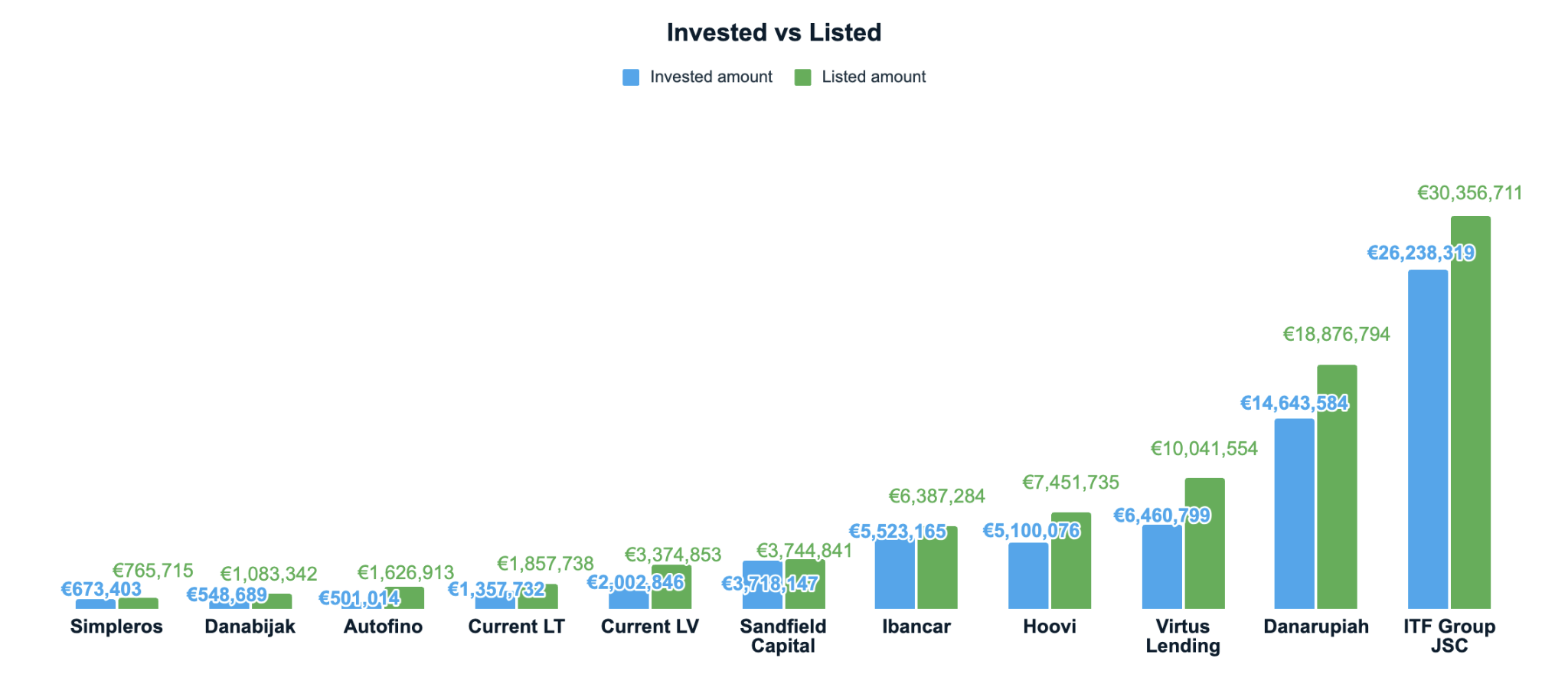

In terms of loan volume, ITF Group JSC was the largest contributor, with €30.36M listed and €26.24M invested. Danarupiah followed with €18.88M listed and €14.64M invested, confirming its continued importance within the marketplace.

New Loan Originators in 2025: Three Additions and Strong Growth

In 2025, we onboarded three new Loan Originators, each adding new lending categories and expanding the platform’s diversity.

Autofino joined the platform with a focus on car loans, listing €1.63M in loans and reaching €501k invested within the year.

Simpleros, focused on payday loans, listed €765.7k and achieved €673.4k invested, demonstrating particularly strong investor uptake compared to listing volume.

Virtus Lending, offering instalment and car loans, became one of the most significant new originators on the platform. In its first year, it listed €10.04M, reached €6.46M invested, and achieved 61.64% investor participation, positioning it as one of the fastest-scaling new additions and a major contributor to overall platform volume in 2025.

With these three additions, Income strengthened its ability to serve a wider range of investor preferences, while also building a more resilient and diversified originator base.

Loan Types: A Closer Look

The composition of loan listings in 2025 reflected both consistency and diversification. Instalment loans remained dominant, accounting for 72.55% of total loans listed. At the same time, new supply from car loan originators supported growth in the car loan category, which represented 8.59% of listed loans. Payday loans also contributed to platform diversification, supporting a broader range of investor strategies across different maturities and loan types.

Welcoming New Investors: Key Trends in 2025

The profile of new investors in 2025 continued to reflect a strong community of retail investors, with 99.01% of new investors being individuals and 0.99% companies.

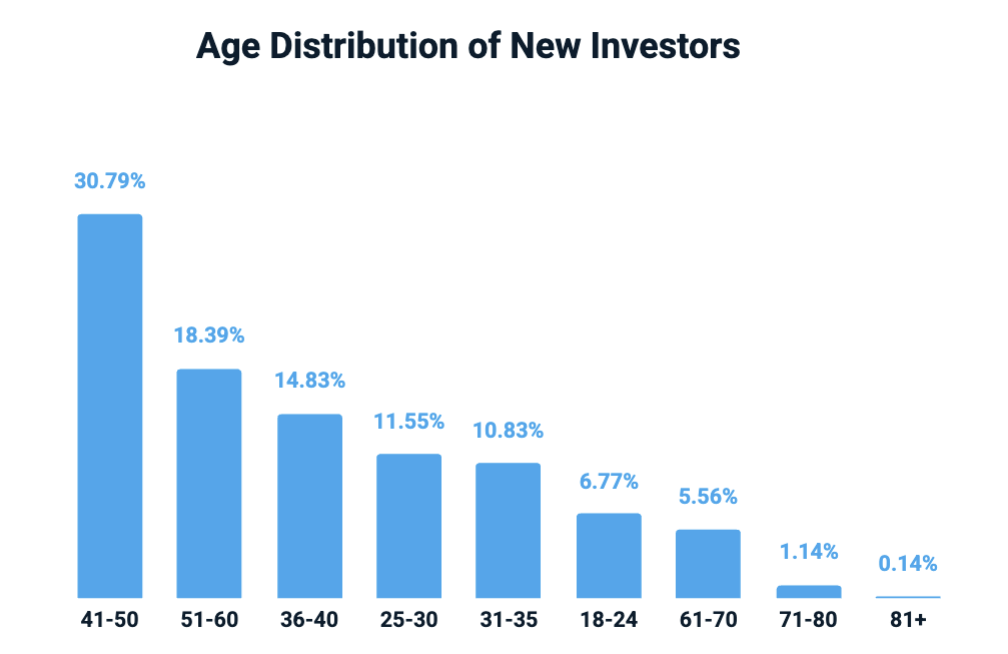

In terms of age distribution, the largest new investor segment was the 41 to 50 age group, representing 30.79% of new investors. This was followed by the 51 to 60 segment at 18.39%, reinforcing that Income continues to attract an experienced investor base with a long-term approach to portfolio building.

Geographically, new investors continued to come primarily from across Europe, with Germany and Spain leading the way, followed by a strong mix of other European markets.

Investor Portfolio Distribution and Portfolio Growth in 2025

The overall distribution of new investor investments on Income in 2025 offers a clear view of how investor behaviour continues to evolve, reflecting both growing confidence in the platform and a strong commitment to building meaningful portfolios over time.

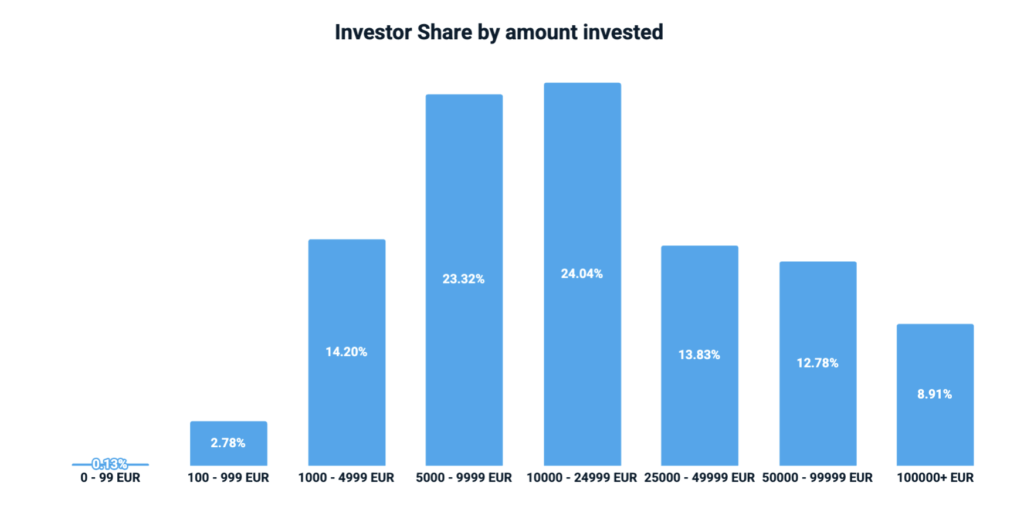

In 2025, the largest share of new investor capital came from portfolios in the €10,000 to €24,999 range, accounting for €5.95M or 24.04% of total investment. This was closely followed by the €5,000 to €9,999 range, representing €5.78M or 23.32%. Together, these two brackets highlight that a substantial portion of new investor activity is concentrated in mid-level portfolio sizes, signalling that many investors are entering Income with a serious long-term approach. At the same time, portfolios between €25,000 and €49,999 contributed €3.43M or 13.83%, and portfolios between €50,000 and €99,999 contributed €3.16M or 12.78%. Notably, portfolios above €100,000 represented €2.21M or 8.91% of total investment, underscoring the continued presence of high-value investors within the platform.

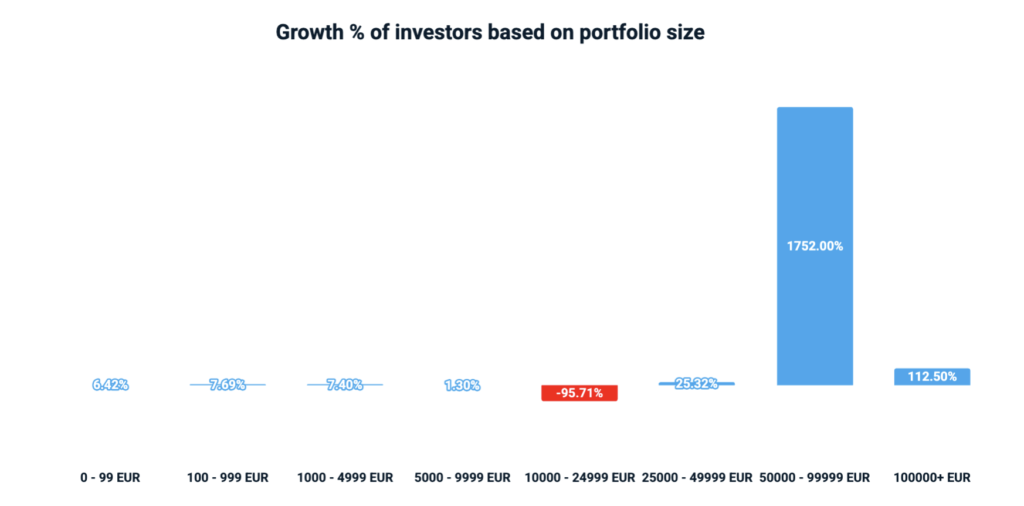

Portfolio growth across brackets in 2025 also tells an important story, highlighting strong momentum in higher-value investor segments. The most remarkable increase occurred in the €50,000 to €99,999 category, which grew by 1752.00%, signalling a significant rise in larger new investor portfolios compared to the previous year. Portfolios above €100,000 also grew by 112.50%, reinforcing the trend of increasing high-value participation. The €25,000 to €49,999 category grew by 25.32%, demonstrating continued strength in the upper mid-level segment. While smaller portfolios also grew, they did so at a more modest pace, with the €100 to €999 segment increasing by 7.69% and the €0 to €99 segment increasing by 6.42%.

At the same time, the €10,000 to €24,999 category saw a decline of 95.71% in growth rate compared to the previous year. This suggests a notable shift in how new investors entered the platform in 2025, with a stronger move toward higher investment brackets rather than continued growth in the mid-level segment.

Overall, the growing share and growth rate of higher-value portfolios reflects the platform’s ability to support both seasoned investors and those scaling their strategies over time. Whether joining for the first time or expanding their commitment, investors continue to demonstrate increasing trust in Income as a reliable and secure platform for long-term investing.

A Key Milestone: Income’s 2025 Funding Round

2025 was also a milestone year for Income’s long-term growth strategy. During the year, we completed a funding round and raised €786,000, strengthening our ability to build new features, expand into additional markets, and grow the platform for the next phase of scale.

This funding milestone reflects continued confidence in Income’s vision and the opportunity ahead.

A Future Full of Promise: What We Are Building Next

Looking ahead, we are focused on making Income an even stronger and more secure platform for investors, while expanding the range of opportunities available on the marketplace.

By Q2 2026 at the latest, we are planning to launch the secondary market, enabling investors to gain more flexibility and manage liquidity more actively. Alongside this, we are also planning to introduce two-factor authentication (2FA), strengthening platform security and adding an additional layer of protection for all investors.

In parallel, we are actively working on bringing more Loan Originators from new markets onto the platform, expanding both geographic reach and loan diversity so investors can access a broader set of opportunities through Income.

“Looking ahead, our focus is clear: responsible marketplace expansion, high operational and security standards, and continued improvements in investment choice – supporting long-term wealth generation for our investors.” — Lavrenti, CEO of Income.

To every investor, Loan Originator, and partner, thank you for being an integral part of our journey. We are excited for what comes next and look forward to building an even more successful year ahead.