Q1 investment update (26th April) 2022

My previous investment update is from the start of the year, so that this update will cover Q1 (Screenshots dated 26th April). I will be doing quarterly updates from now unless something exciting happens that needs to be reported in between.

During Q1 months, a lot has happened on the Income marketplace; we’ve finalized our latest funding round and seen a steady inflow of new investors. The primary loan originators (LO) keeping up the supply of investable loans have been Danarupiah (Indonesia) and Vivus (Mexico), both established LOs offering 12% interest rates to investors. I’ve been investing in both actively.

My auto-invest strategies on Income accept loans up from 10% p.a., so my strategy of staying over 10% p.a. in loan marketplaces is holding. During Q1, we’ve had some moments when investor demand has exceeded the loan supply, so I’ve been switching auto-invest on and off to allow other investors to get loans which has caused a slight cash drag on my account.

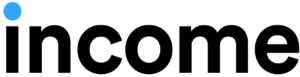

Portfolio on Income

I’m currently only investing on Income, where I now have €81,653.33 invested.

I will keep increasing my portfolio on Income and, in these times of high inflation, keep excess cash in short-term loans.

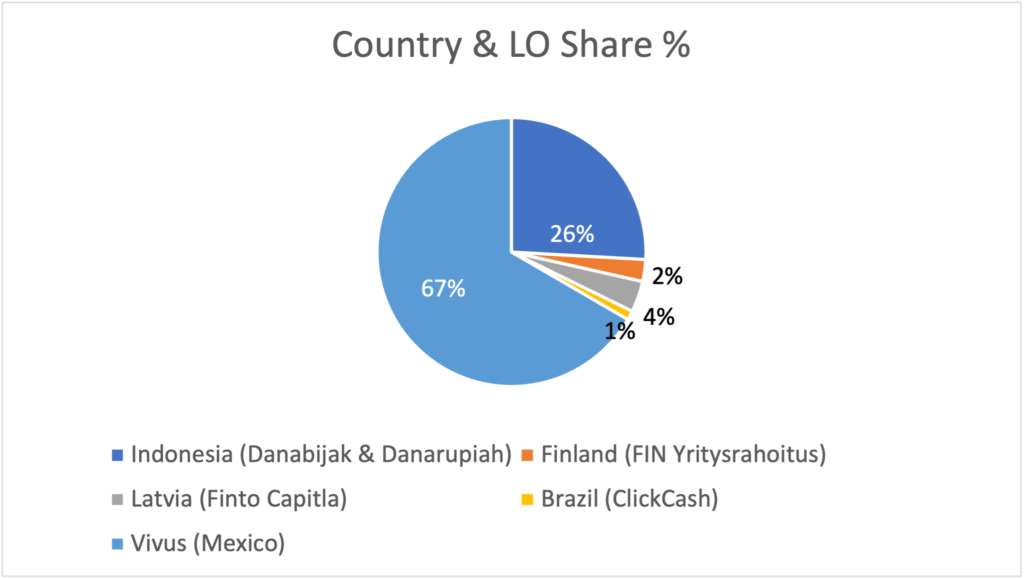

I’ve grouped the LOs according to the geographical split for this report.

Danabijak’s & Danarupiah’s share has dropped with the addition of Vivus from Mexico. The short maturities and high yield from Indonesian LOs combined with significant junior shares have been increasingly popular with investors, thus causing a shortage of loans, so I’ve invested more in Vivus.

ClickCash from Brazil continues to list limited amounts on the platform, and my share in their loans has dropped to only 1% as the loans amortize as per schedule.

Fin-Yritysrahoitus from Finland is listing limited amounts of SME loans on the platform, and so their share in my portfolio has also dropped to 2%

Finto Capital from Latvia is listing, but their long-term loans limit investor interest despite their attractive 12% yields.

Vivus from Mexico is the newest LO to join Income in Q1 2022.

Income Account overview

I’ve been investing on the Income marketplace since the end of January 2021. The amount invested has been fluctuating. Still, I’ve earned 11.86% on my investments p.a., which equals € 6 198.67 interest earned, and € 612,07 is already accrued, which is yet to be paid in cash.

My portfolio split of 82,3% late can be considered an excellent result, meaning a large amount of the book is current.

I’m looking forward to new loan originators joining Income and increasing my investments.