This post explains how the two primary security structures Income uses work. As we are a global marketplace for loans and co-operate with loan originators in different jurisdictions, the same approach does not always work. Each jurisdiction has its specifics that we consider during onboarding and confirm the validity of structures with local law firms. Regardless of the structure used, our approach to investor security remains the same.

Currently, we use two different types of structures;

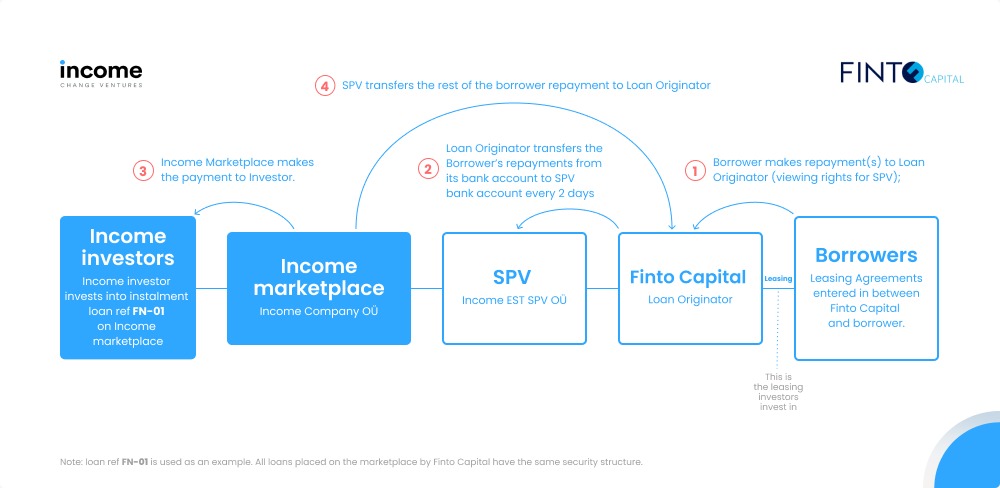

a) the direct assignment structure where the underlying loan is assigned to the investor and the junior share is subordinated to the investable share.

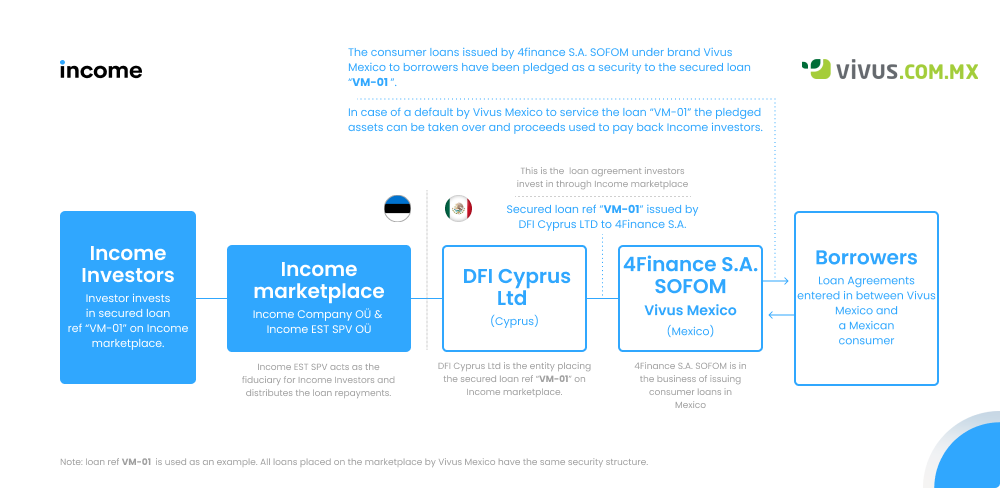

b) A pledge structure, where a loan book is pledged at certain % to Income’s SPV that looks after the investors’ interests. Like the junior share mechanism, the pledge is set to a level based on our analysis, where the pledge % on assets is high enough to cover investors 1:1 in the case of LO default.

Direct assignment example:

In a direct assignment case, if the junior share is 20% (€200 000) and the total portfolio of LO on Income is €1 000 000, the investors can only invest up to, e.g., 800 000€. In the case of a default, the investors get paid first from the proceeds coming from the portfolio. The junior share is agreed with the LO to be a first loss component, meaning Loan Originators will lose it entirely before investors incur losses. You can read more about junior share here (link to blog)

It’s good to note that the investor is assigned a part of each claim directly in the assignment structure.

Pledge example:

If a pledge secures the investment, the investor invests in a loan given to the loan originator, secured by a pledge on the loan originator’s assets; loans in their loan portfolio are given to local borrowers. There is no junior share in these loans as the protection mechanism works differently.

Using the same example as above, where the LO’s total portfolio on Income is €1 00 000, and in the assignment structure case, the junior share would be 20%. The investable part would be 80% of the total portfolio (€1 000 000).

The pledge structure has no junior share, so 100% is investable, e.g., €1 000 000. This amount is secured by a pledge on loan assets worth €1 250 000. Thus the investable part of €1 000 000 is 80% of the value of the pledges. In case of a default, Income SPV (Special Purpose Vehicle) would collect €1 250 000 worth of loans to cover €1 000 000 worth of investor claims. This gives similar protection as the junior share mechanism.

It’s good to note that in this structure, the investor is secured by a pledge on assets given to SPV owned by Income that acts in the interest of investors. This is because it would be impossible to pledge the assets directly to individual investors, and therefore an SPV is needed.

In simple terms, with a direct assignment structure (Danarupiah, Danabijak, Finto, and Fin Yritysrahoitus), you invest into one loan where LO directly holds a junior part. With the pledge structure (ClickCash, Vivus), you invest in a loan secured by pledges against the loan originator’s portfolio in the amount that corresponds to what the % of junior share would be if we were to use the assignment structure. In essence, the pledges act the same way as junior shares in case of loan originators default to protect the investment if the LO defaults.