As we close the chapter on 2024, it’s the perfect time to reflect on a year defined by growth, new milestones, and deepening trust within our community. Income’s platform has expanded in the past year—welcoming more investors, diversifying loan originators, and strengthening portfolios. Here’s a comprehensive recap of our 2024 highlights and achievements.

A Strong Year for Our Platform: Performance Overview

In 2024, €59.5 million worth of loans were listed, offering our investors diverse opportunities. Investor confidence remained evident, with €57.4 million successfully invested, representing a steady increase compared to the previous year. More importantly, €50.5 million in repayments were made to investors, reflecting the ongoing success and reliability of loan performance.

Our active portfolio saw an impressive 77% growth on the platform, compared to a 53% increase in 2023. This growth speaks volumes about our community’s trust and engagement. While the average interest rate slightly decreased to 13.66%, the platform maintained its appeal by offering consistently competitive returns.

“Our mission has always been to empower investors by providing them with secure, high-yield opportunities. 2024 proved that when trust, transparency, and innovation come together, growth follows naturally.” — Lavrenti, CEO of Income.

Loan Originators (LOs): Driving Success and Expanding Horizons

Loan originators are crucial in providing a steady flow of diverse and valuable investment options. This year, our loan originators made significant contributions:

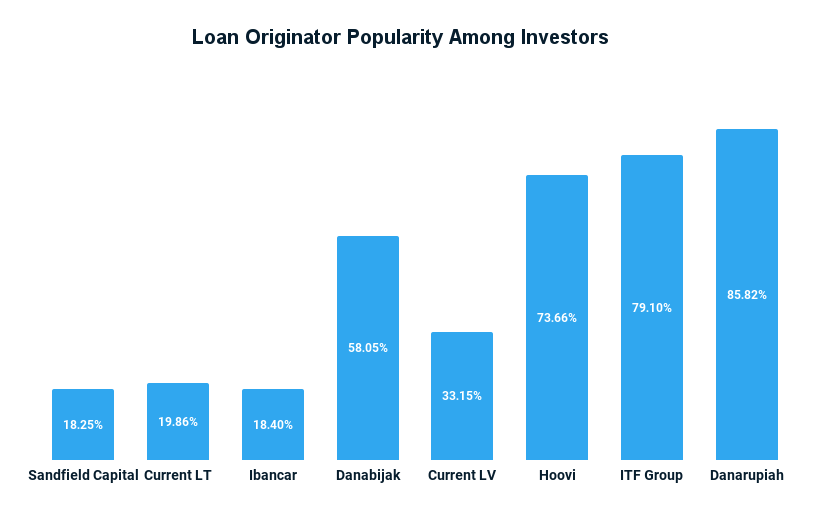

- Top Performers: Danarupiah emerged as the standout, with 85.82% of investors investing in their loans, followed by ITF Group (79.10%) and Hoovi (73.66%).

- Newcomer Highlights: Current LV, Current LT, Sandfield Capital, and Ibancar joined the platform in 2024 with promising early engagement rates between 18.25% and 19.86%.

Investments and listings Across LOs: Building Confidence

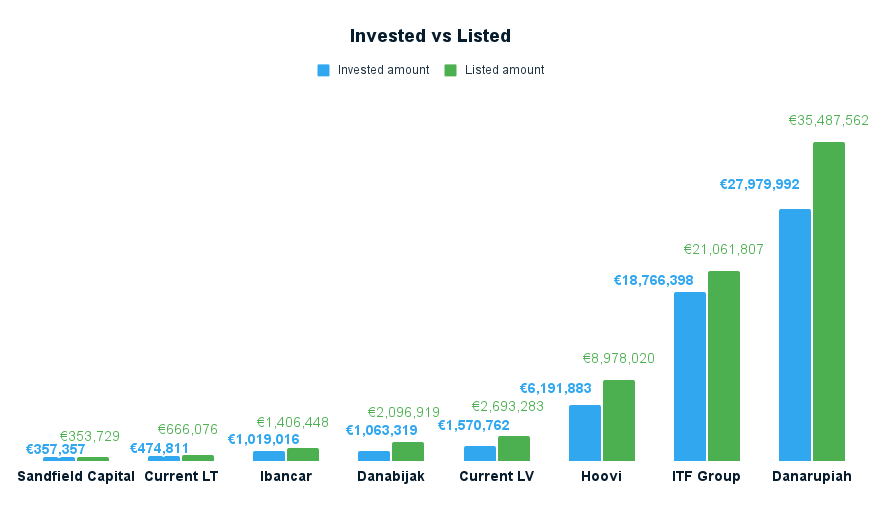

Danarupiah continued to dominate, attracting €27.9 million in investments, while ITF Group and Hoovi followed with €18.7 million and €6.1 million, respectively. Newcomers like Ibancar and Sandfield Capital also showed early traction, reflecting the growing demand for diversified offerings.

Loan Types: A Closer Look

A breakdown of loans listed in 2024 reveals that instalment loans remained the preferred format, making up 88.1% of the listings. Other categories, such as car rental loans (4.6%), short-term loans (3.7%), and secured loans (3.1%), highlight the variety of options available for different investor strategies.

Welcoming New Investors: Key Trends in 2024

New Investor Demographics and Geographic Reach

Investor Type: The vast majority—98.3%—of our new investors were individuals, with 1.7% being companies. A key milestone in 2024 was the beginning of our partnership with our first institutional investor – i2 Group, marking an exciting step toward further diversification and signaling strong potential for future growth in institutional participation.

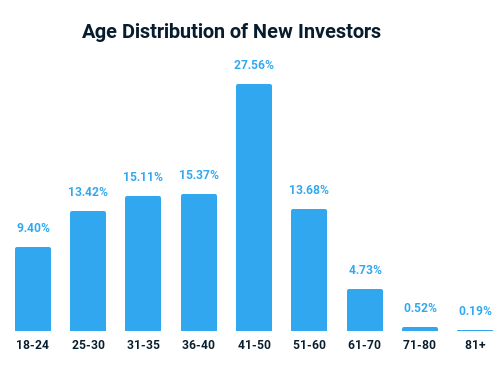

Age Distribution: The 41–50 age group led the way, making up 27.56% of new investors, followed by the 31–35 and 36–40 brackets.

Countries Represented: Our investor base became even more diverse, with Germany (26.39%) and Spain (16.21%) contributing the largest shares of new investors. France, Portugal, and Romania remained key markets, showcasing our continued expansion across Europe.

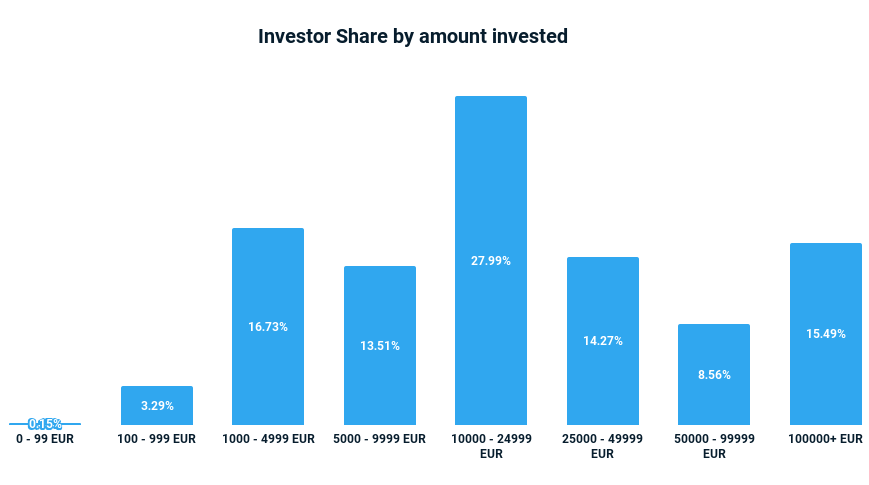

The overall distribution of investments on Income at the end of 2024 offers a fascinating glimpse into the evolving behaviour of our investor community and their growing confidence in the platform.

Approximately 44.72% of investors held portfolios between €5,000 and €49,999, highlighting a strong commitment from mid-level investors. Notably, portfolios exceeding €100,000 represented 15.49% of total investment, underscoring the increasing presence of high-value contributors.

In contrast, portfolios below €100 made up only a small 0.15% of the total, further emphasizing the shift toward substantial portfolio sizes and long-term trust in the platform.

Portfolio Growth in 2024:

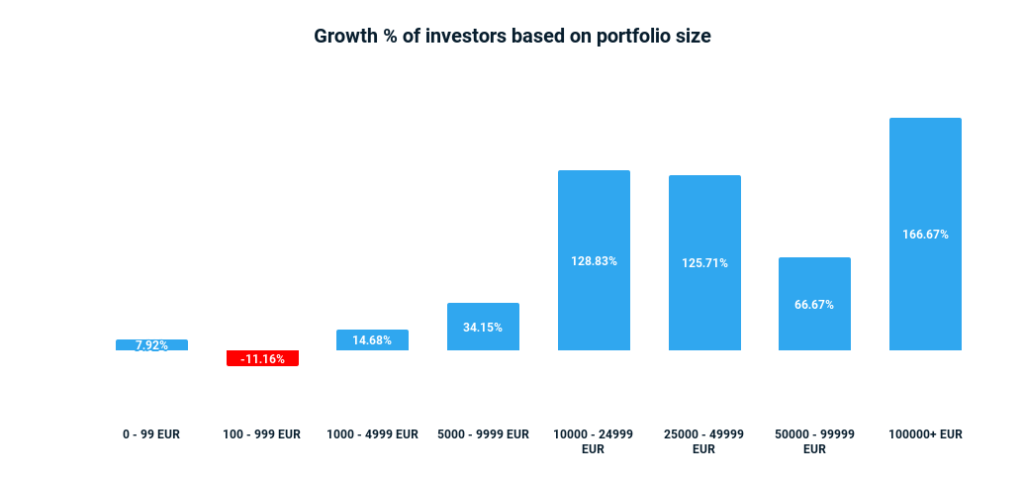

The overall growth in investor portfolio sizes across categories in 2024 was remarkable, demonstrating a continued trend toward larger investments:

- Portfolios over €100,000 saw an exceptional increase of 166.67%.

- The €25,000 to €49,999 range grew by 125.71%, while the €10,000 to €24,999 range rose by 128.83%.

This upward trend continued across the €5,000 to €9,999 category, showing 34.15% growth. Meanwhile, smaller portfolios in the €100 to €999 range saw an 11.16% decline, indicating that more investors opt to increase their commitment to larger portfolios.

The growing percentage of high-value portfolios reflects the platform’s ability to cater to both seasoned investors and those expanding their financial strategies. Whether joining for the first time or continuing to grow their portfolios, investors place more trust in Income as a reliable, secure investment platform.

A Future Full of Promise

Reflecting on 2024, it’s clear that Income’s success is built on trust, community, and opportunity. Our platform continues evolving, empowering seasoned and new investors with a secure, rewarding, and innovative investment experience.

“Looking ahead, we remain focused on scaling our impact, growing our partnerships, and building a future where financial growth is more accessible to all.” — Lavrenti, CEO of Income.

We enter 2025 with a commitment to enhance our platform further, grow our partnerships, and unlock even more potential for our investors. To every investor, loan originator, and partner—thank you for being an integral part of our journey. Here’s to an even more successful year ahead!