There are two main risks for the investor on loan marketplaces and P2P platforms.

a) Risk of Borrower default

b) Risk of Loan Originator (LO) default

Risk a) is covered on most platforms by a “Buyback Guarantee”, a promise from the Loan Originator that if the end borrower is late with payments by more than 60 days, the LO buys the investment back from you with interest. All loans on Income come with Buyback Guarantee and this is a standard feature on most modern marketplaces.

Risk b) is not covered on most platforms by any additional security measures. This means that if the LO cannot honour its promise of buyback guarantee, or goes bankrupt for some other reason, the investors have no additional buffer or protection to ensure they get their money back.

Income marketplace is the only platform that has something called a “Cashflow Buffer” in place to protect investors against risk b)

How do we set the Cashflow Buffer?

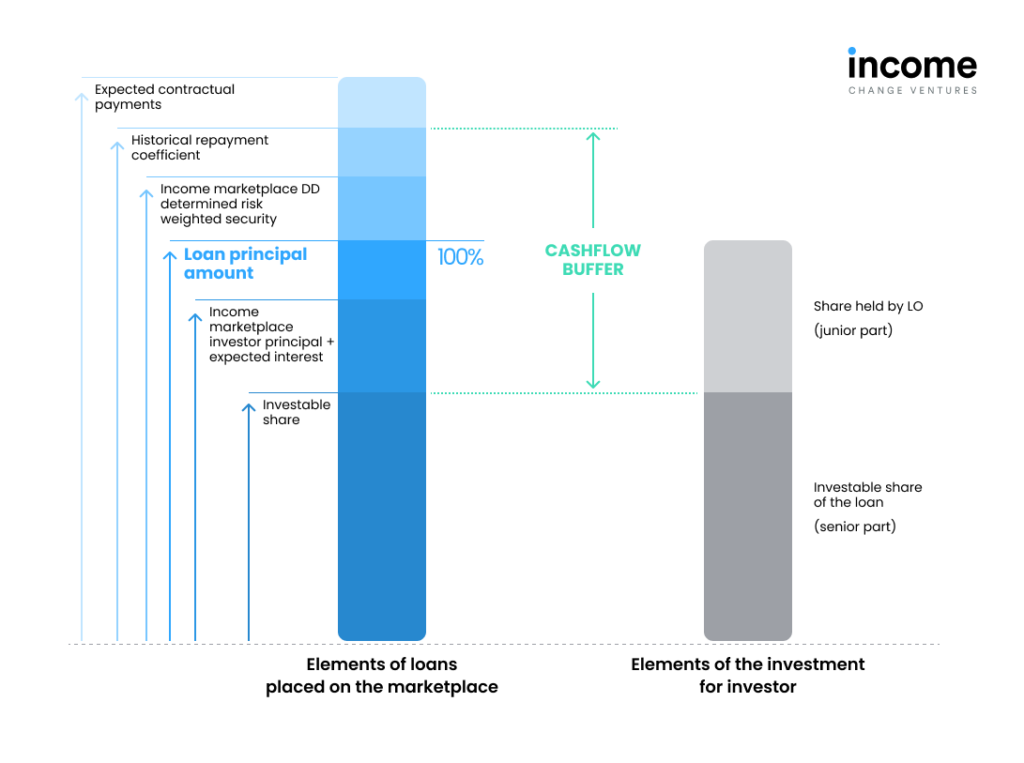

When we do our due diligence on a loan originator a special emphasis goes on understanding the quality of their loans, and how much cash do those loans generate on a portfolio basis (“historical repayment coefficient” in graph), and how profitable are they. It is extremely important to understand this thoroughly, as the loan portfolio placed on Income is used as the security to protect investors against Loan Originator default. In simple terms, when we look at the loan portfolio, we want to understand the value of the security; similar to a real estate loan where you would look at the value of the building.

Once we have established the base value of the security we look at different possible risks that could materialize, such as currency FX changes or an additional wave of the COVID-19 outbreak. We then adjust the value accordingly. Once these calculations are done, we look at how much “Junior Share” (Read more here) is needed so that the investor would be fully covered in case of trouble. It is good to note that if the loan quality is good, and there are not many additional risks identified, the Junior Share can be 0%, and the investor would still be fully secured.

In short; the combination of loan profitability, risk adjustments and Junior Share form what we call the “Cashflow Buffer”.

How does the Cashflow Buffer work?

If there is a loan originator default on Income, and we need to take over the loan portfolio, the cashflow buffer goes to work. It means that we start collecting money back from the portfolio for our investors, and all the profit from the portfolio as a whole as well as the Junior Share will be first used to pay investor principal and interest. Only when the investors have been fully repaid are the remaining amounts then transferred to the Loan Originator.

For example:

If 1000 loans originated by Loan Originator X have been invested in by investors on Income marketplace and the Loan Originator defaults, those 1000 loans are taken over by Income and we start collection on behalf of our investors. For this purpose Income has existing agreements with local collection companies.

The loans where the end borrower pays back on time are naturally covered by borrower repayments. The loans where the borrower does not repay are covered from the Cashflow Buffer (as there is no longer a working “buyback guarantee” due to LO default).

So if there are 1000 loans out of which 800 perform normally and 200 do not perform, the Junior Share and excess earnings from all 1000 loans are used to cover the 200 non-performing loans as per the original schedule. This way everyone gets their investment back in a simple and fair way.

Conclusion:

There is no other marketplace for investing in loans that would have the same level of security that the Junior Share and Cashflow Buffer together provide for investors. We strongly believe that due to these features, Income is currently the safest marketplace for investing in loans.

Register now and start earning.