Here is an update on my loan investments portfolio for August & September.

My previous investment update was for July, so this post will cover August and September. During these two months a lot has happened on the Income marketplace; the mobile app with a simplified UX was launched and new loan originator Finto Capital was listed and has become a part of my portfolio. I´m actually mostly using the mobile app to manage my portfolio these days as I think the new UX is much better.

Over the two months I continued withdrawing funds from Mintos, and I can consider the withdrawal completed as I only have €112.27 left there. Thus, I will not be covering my Mintos portfolio in detail in future updates, unless I decide to start investing there again.

My auto-invest strategies on Income have been mostly set to pick loans with a 12% p.a. yield, so my strategy of staying over 10% p.a. in loan marketplaces is holding. So far I´ve earned 11,87% on Income vs 10,67% p.a. on Mintos.

Portfolio split by marketplace

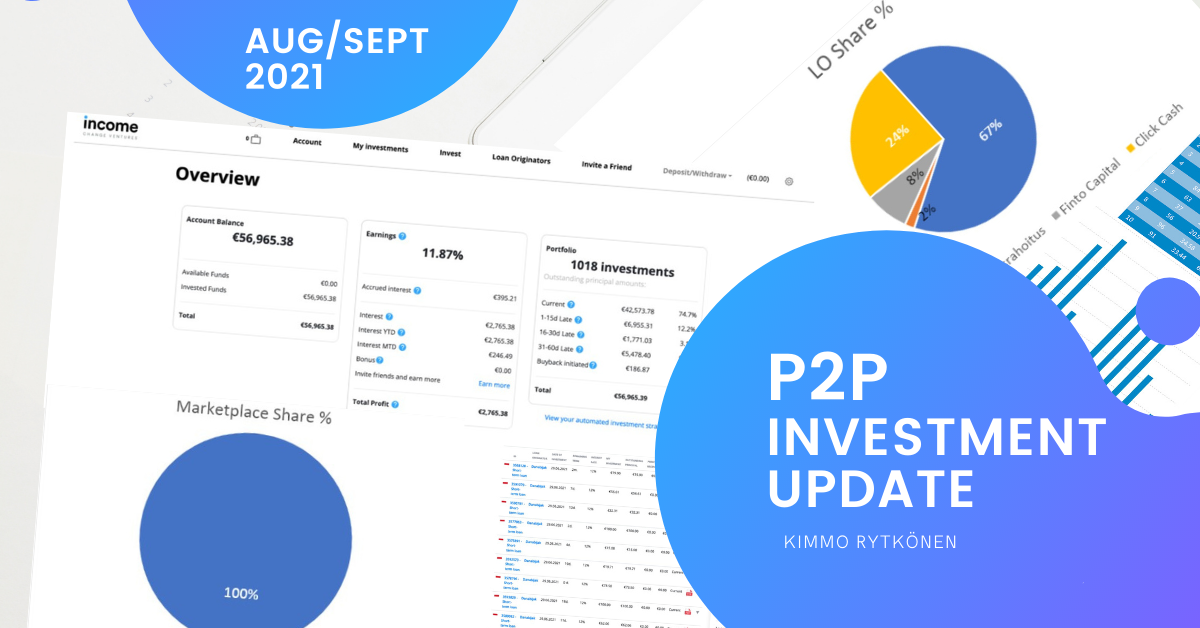

With regards to investing in loans, I´m practically only invested in Income. My portfolio on Income is now at €56,965.38 and I´m not planning any significant increase in the short term, this is driven partly due to the limited amount of loans available on Income, but also due to my overall investment diversification strategy in other assets (crypto, stocks, and real estate)

Portfolio split by LO

Danabijak´s share (67% vs 71% last month) of my portfolio fell as they have not been able to list enough loans to keep up with growing investor demand. The relatively short maturities, combined with high yield, have been increasingly attractive to investors, and I believe this trend will continue.

ClickCash grew from 20% to 24% in my portfolio. Their offer which is mostly 12 month loans has been well received by investors, and ClickCash loans are sold out on the platform at the time of writing.

Fin-Yritysrahoitus decreased from 3% to 2% in my portfolio as the loans got repaid as per schedule, but as no new loans were listed the autoinvest allocated these funds to other loan companies (as per my chosen strategy)

Finto Capital, the new loan company on Income marketplace recently started their listing with long term loans offering 9-12% and I picked up on their offer immediately; I now have 7% of my portfolio invested in Finto. As I´ve previously mentioned, the secondary market is under development, and this will provide investors with the chance to exit from longer loans, which makes the Finto loans even more attractive.

Income Account overview

I´ve been investing on Income marketplace since the end of January and have gradually increased the size of my investments. I´ve since earned 11.87% on my investments p.a., which equals €2,765.38. I have also accrued €395.21 of interest on my investments which will move to the “interest” and “total profit” line when the next payments from the LOs come.

My portfolio split of 74.7% in current and 12.2% in 1-15 day late can be considered a very good result, meaning 86.9% of the book is current or nearly current.

“Buyback Initiated” is a new name to a bucket previously called “60+d late” which was confusing to investors, so it was recently changed. The 0.3% in this bucket I expect to be covered by LO buybacks in next clearing.

Mintos account overview

I started investing on Mintos in 2019 and quickly grew my portfolio to over €100,000. I´ve since earned 10.67% on my investments p.a., which equals €13,077.87. I won’t be posting another update on Mintos unless I start again investing with them. I can positively say that I did not incur any significant losses on Mintos, and my net annual return remained above 10%. The cashflow back from the portfolio was also quite fast once I stopped investing, so in the end investing on Mintos was not an overall negative experience.