Start of the year investment update – 4th of January, 2022

My previous investment update is from September so this update will cover October, November, and December.

During these months, a lot has happened on the Income marketplace; we’ve seen a steady inflow of new investors and have seen short-term loans selling out. The loan originators have tried to keep up with the investor demand to place more loans, but demand continuously exceeds supply.

The latest loan originator onboarded in December is Danarupiah (you can read more about them here). Shortly put, Danarupiah is a very established loan company and listing loans on Bondster and Mintos. On Income, they have a 35% junior share (vs. 5-15% skin in the game on other marketplaces), so the risk-reward ratio on Income is the best in the market currently, and I picked up some of their loans to my portfolio.

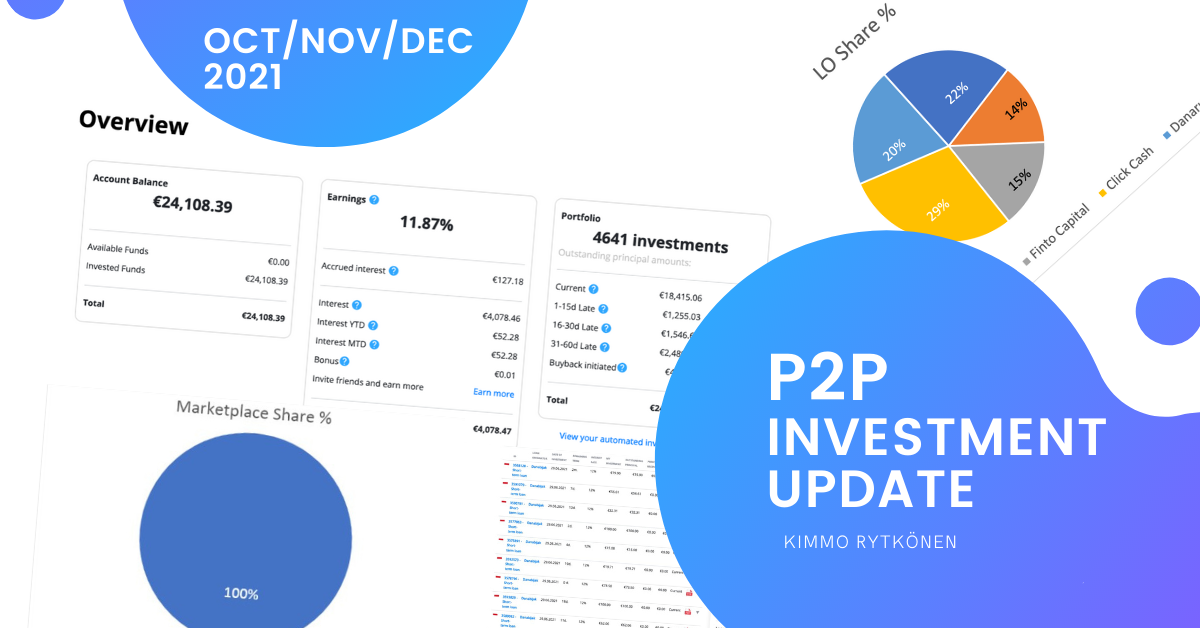

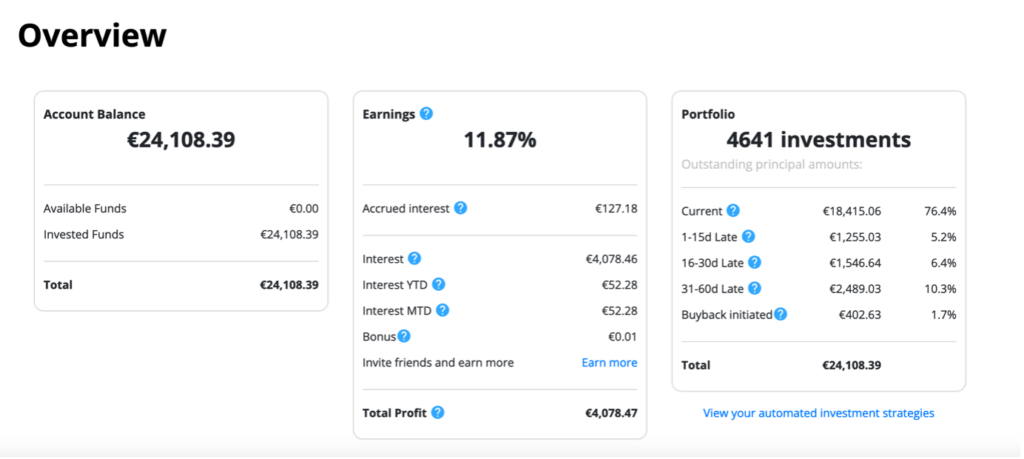

I previously set my auto-invest strategies on Income to pick loans with a 12% p.a. yield, but I’ve adjusted them now to accept loans up from 10% p.a., so my strategy of staying over 10% p.a. in loan marketplaces is holding. So far, I’ve earned 11.88% on Income, a total of €4072.96 in 2021.

Portfolio on Income

I’m only investing in Income, and I now have €24,108,39 invested. In September, I had €59,965.38, but in the meanwhile, two things happened which attributed to the drop.

Due to LO’s inability to list enough loans to satisfy all investor demand, I switched off my auto-invest strategies to make more loans available for 3rd party investors. Switching off my auto-invest freed up cash very fast.

I also invested in real estate, and an opportunity to buy an apartment in a historical building in Tallinn came up, so I decided to deploy the free funds there.

The second point highlights that in addition to loans being an excellent fixed-income investment, they are also a great parking place for cash for those who wish to keep their money working while waiting for the right time to make other investments.

I will now slowly start increasing my portfolio again on Income and in these times of high inflation to keep excess cash in short-term loans.

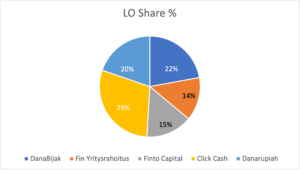

Portfolio split by LO

Danabijak’s share (22% vs. 71% in September) of my portfolio fell as they have not been able to list enough loans to keep up with the growing investor demand. The short maturities and high yield combined with significant junior shares have been increasingly popular with investors. I also switched off my auto-invest not to reduce the supply for other investors further.

ClickCash increased from 24% to 29% in my portfolio. Their offer, which is 12-month loans, is also well received by investors, and ClickCash loans are sold out on the platform when writing this. Click Cash is also listing limited amounts currently.

Fin-Yritysrahoitus increased from 2% to 14% in my portfolio as they started listing more loans with a slightly higher interest rate. The company has recently updated its origination pricing and opened up new sales channels, which positively affect the volumes and the price they can offer to investors on certain loans.

Finto Capital, the new loan company on the Income marketplace, recently started their listing with long-term loans offering 9-12%. I picked up on their offer immediately; thus, I now have 15% (7% in September) of September my portfolio invested in Finto. As I’ve previously communicated, the secondary market is under development, and this will allow investors to exit longer loans which makes the Finto loans even more attractive.

Danarupiah, the newcomer on Income and in my portfolio, is an established Fintech from Indonesia, and I have 20% of my portfolio invested in their loans.

Income Account overview

Since the end of January 2021, I’ve invested in the Income marketplace and gradually increased my investments until October. I’ve since earned 11.87% on my investments, p.a., which equals €4078.47.

My portfolio split of 76.4% in current and 5.2% in 1-15 days late can be an excellent result, meaning 81.6% of the book is current or nearly current.

“Buyback Initiated” is a new name to a bucket previously called “60+d late,” which confused investors, so we changed it recently. I expect LO buybacks to cover the 1.7% in the next clearing.

I’m looking forward to new loan originators joining Income and increasing my investments again each month.